reverse tax calculator australia

Here are the Australian income tax rates and brackets for the 202122 financial year for Australian residents according to the Australian Taxation Office ATO. Tax planning tax advice.

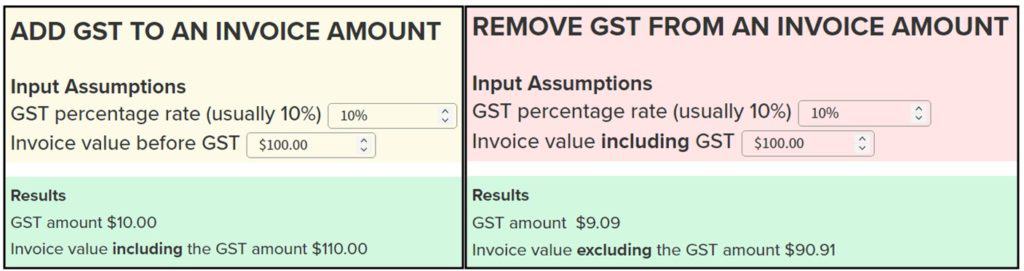

Gst Calculator Australia Atotaxrates Info

You can even.

. Enter your Annual salary. This financial year started on 1 July 2021 and ends on 30 June 2022. Tax refund estimate or free tax refund calculator.

As well as entrepreneurs and anyone else who may need to figure out just how. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. Information you need for this calculator.

Budget 2022-23 This calculator has been updated. And provides a breakdown of your annual salary with Monthly Quarterly Weekly Daily and Hourly pay illustrations. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes.

Simple calculator for Australian income tax. For salary and wage payments made on or after 1 July 2022 the new superannuation guarantee contribution rate of 105 will apply. If you decide to complete and sign your tax return most people finish in just minutes our qualified accountants check your return and look for suggestions about further deductions or adjustments that can boost your.

Calculating income tax in Australia is easy with the Australia Tax Calculator and Australia Salary Comparison Calculator simply follow the steps below. How to calculate income tax in Australia in 2022. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

The only thing to remember in our Reverse Sales. Current HST GST and PST rates table of 2022. It is always was 10 rate thought there are attempts to increase it to 15 but it didnt happened yet.

Before you use this calculator. To calculate Australian GST at 10 rate is very easy. Simply enter your numbers and our tax calculator will do the maths for you.

Compound Interest in 25 Seconds. All Australia Tax Calculators on iCalculator are updated with the latest Tax Rates and Personal Allowances for 202223 tax year. Business tax.

The Reverse Tax Calculator is part of the Lawyers Section of Dolman Bateman. Each pay calculator includes personal tax allowances calculates your pension and medical deductions etc. Lodge Online Make an Appointment Find an Office.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. It can be used for the 201314 to 202122 income years. Amount without sales tax GST rate GST amount.

Tax rate for all canadian remain the same as in 2017. For example if the full payment is 5798 and you paid 107 sales tax you can enter these numbers into our calculator to determine your original pre-tax price. Lodging a tax return.

Australian Goods and Services tax history. Our simple tax calculator is updated every year in conjunction with the Australian Taxation Offices Pay As You Go PAYG schedules. Just multiple your GST exclusive amount.

Then find out how you can pay less tax. Sacrificing part of your salary can reduce your tax. See the article.

The Tax Return Calculator is a free part of the Etax online tax return a paid tax agent serviceThe calculator provides an instant estimate of your tax refund or payable. Call 1300 829 863. Amount without sales tax QST rate QST amount.

When you cant use the. Helps you work out. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

This app is especially useful to all manner of professionals who remit taxes to government agencies. Reverse Sales Tax Calculations. Your marginal tax rate.

For example if you paid 2675 for items. The base amount for the 2021-22 income year has increased to 675 and the full amount is 1500. The rates in the above tables do not include the Medicare levy of 2.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Up next in Income tax. This calculator can also be used as an Australian tax return calculator.

Find out more about the ATOs rates. So check your payslip employer is paying you the correct amount of super. What your take home salary will be when tax and the Medicare levy are removed.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Instant Salary Calculation for 202223 Tax. Rather than calculating sales tax from the purchase amount it is easier to reverse the sales tax and separate the sales tax from the total.

Here is how the total is calculated before sales tax. Jun 17 2013 104200 AM We have just released a new calculator in the Lawyers Section - Compound. Simple steps to lodge your 2022 tax return online.

How much Australian income tax you should be paying. Select advanced and change the setting to suit. Updated with 2022-2023 ATO Tax rates.

Please be mindful that our tax calculations are only estimates. Sales Tax Rate Sales Tax Percent 100. Adding 10 to the price is relatively easy just multiply the amount by 11 reverse GST calculations are quite tricky.

This easy-to-use calculator can help you figure out instantly how much your gross pay is based on your net pay. To find out what your final tax return summary will look like call 13 23 25 and let our tax accountants walk. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax.

How to calculate Australian GST manually. If your taxable income is less than 126000 you will get some or all of the low and middle income tax offset. GST in Australia was started to charge on 1st of July 2000.

To find out more about joining the Lawyers Section click here. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Wanna make 20 bucks. Instantly calculate your tax return refund by inputting your numbers into our Australian Tax Return Refund Calculator. Please enter your salary into the Annual Salary field and click Calculate.

How much Australian income tax should you be paying. As announced in the 202223 federal Budget the low and middle income tax offset has been increased by 420 for the 2021-22 income year. Price before Tax Total Price with Tax - Sales Tax.

The GST is a broad-based tax of 10 on the supply of most goods services and anything else consumed in Australia. CALCULATE YOUR REFUND NOW. A pay period can be weekly fortnightly or monthly.

Call 1300 829 863 Tax Today Australias leading Tax Agents that provide Instant Tax Refunds have offices in Sydney Melbourne and Brisbane.

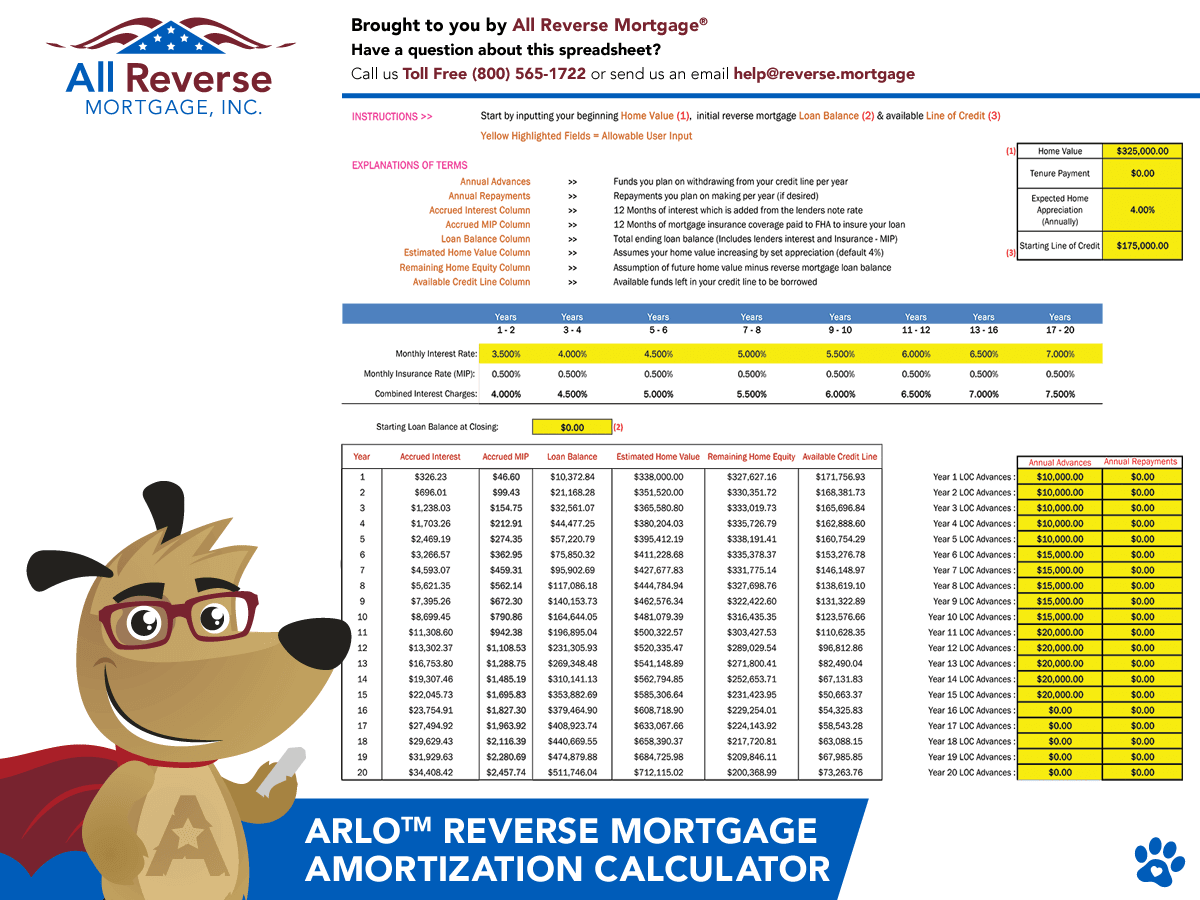

Free Reverse Mortgage Calculator Reverse Mortgage Mortgage Amortization Calculator Mortgage Loan Originator

Reverse Percentages Calculator Online

Alberta Gst Calculator Gstcalculator Ca

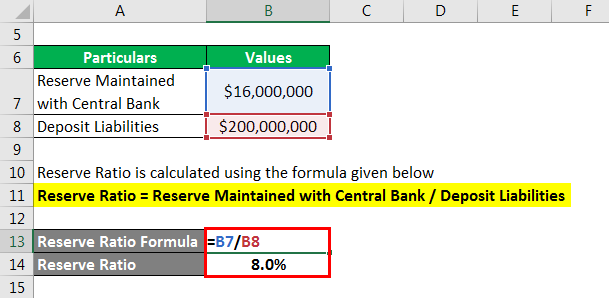

Reserve Ratio Formula Calculator Example With Excel Template

Reverse Tax Calculator Net To Gross

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Aged Care Finance Seniors First Retirement Finance Services Mortgage Brokers Reverse Mortgage Mortgage Loans

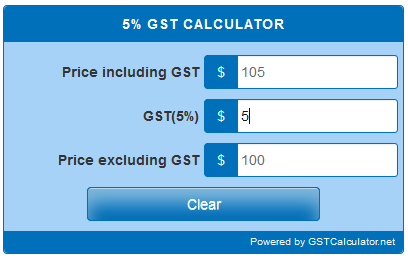

5 Percent Gst Calculator Gstcalculator Net

Free Reverse Mortgage Amortization Calculator Excel File

Realtor Mortgage Broker Deluxe Gold Ring Theme Business Card Zazzle Com Mortgage Brokers Online Mortgage Mortgage

6 Percent Gst Calculator Gstcalculator Net

Rental Property Analysis Spreadsheet Investment Analysis Commercial Property Analysis

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

5 Simple Steps For 1000 Emergency Funds Emergency Fund Reverse Mortgage Mortgage Payoff

![]()

Free Income Tax Calculators Australia Ashburn Tax Accountants

Ugru Crm Vs Salesforce Vs Wealthbox Vs Redtail Vs Zoho For Mobile Email Calendar Workflows And Tasks Crm Financial Planner Financial Planning Organization

Three Statement Financial Excel Models Valuation Financial Modeling Financial Excel